- Messages

- Profiles

- Business

Model - Management Discussion

and Analysis - Stewardship

- Integrated Risk Management

- Corporate Governance

- Annual Report of the Board of Directors on the Affairs of the Bank

- Report of the Audit Committee

- Report of the Human Resources and Remuneration Committee

- Report of the Nomination and Governance Committee

- Report of the Board Integrated Risk Management Committee

- Report of the Credit Approval Committee

- Report of the Related Party Transactions Review Committee

- Directors’ Statement on Internal Control

- Independent Assurance Report

- Investor

Relations - Financial

Reports- Financial Calendar

- Statement of Directors’ Responsibilities in Relation to Financial Statements

- Chief Executive’s and Chief Financial Officer’s Statement of Responsibility

- Independent Auditors’ Report

- Income Statement

- Statement of Profit or Loss and other Comprehensive Income

- Statement of Financial Position

- Statement of Changes in Equity

- Statement of Cash Flows

- Notes to the Financial Statements

- Other Disclosures

- Supplementary

Information

Management Discussion and Analysis

Value Creation and External Capital Formation

External capital is derived directly from our stakeholders; it is the value underpinning the diverse stakeholders of the Bank and the Group. The synergy between our internal and external capitals powers our business to deliver value to, and derive value from our stakeholders. Our commitment to the resilience of our relationships and profitability of our partnerships helps to increase the value we derive from our external capital in the years to come.

INVESTOR CAPITAL

Shareholder Profile

The Bank had 8,728 shareholders on 31 December 2017 (corresponding to a figure of 8,776 as at 31 December 2016), with the total number of shares in issue remaining fixed at 265,097,688 ordinary shares. Institutions account for approximately 84% of the Bank’s share capital. 76% of the Bank's share capital is held by local shareholders, both institutional and individual. Similarly, local shareholders account for 98% of all shareholders.

Return to Shareholders – Bank

| Description | 2017 | 2016 | ||

| Profit for the year (LKR million) | 4,415 | 3,289 | ||

| Return on total assets (%)* | 1.48 | 1.30 | ||

| Net assets per share (LKR) | 180.60 | 172.95 | ||

| Earnings per share (LKR) | 16.65 | 12.41 | ||

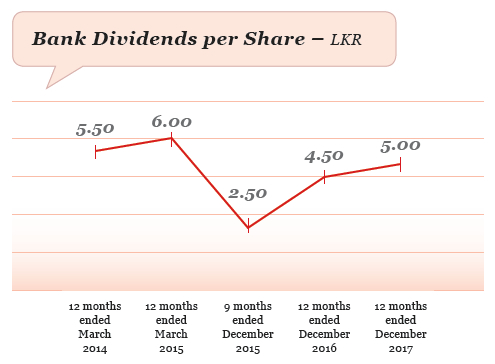

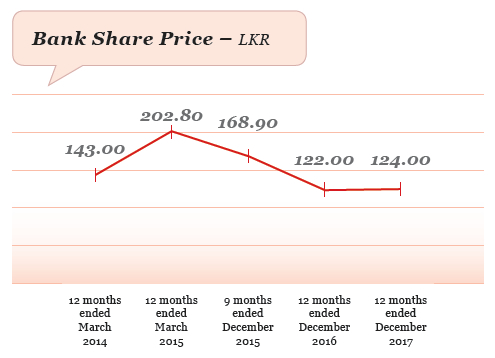

| Dividend per share (LKR) | 5.0 | 4.5 |

* After eliminating fair value reserve

Financial Return

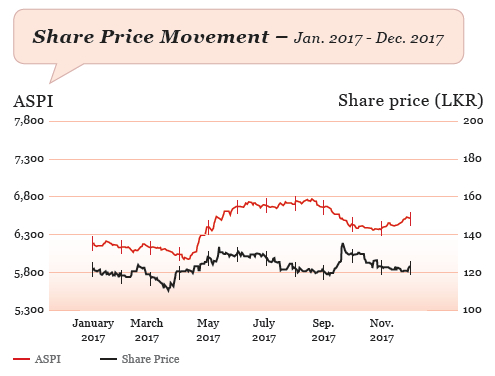

The Bank aims to regularly provide high total shareholder returns through profitable and sustainable performance.

The Directors approved a first and final dividend of LKR 5.00 per share for the year ended 31 December 2017. Dividends are based on growth in profits, while taking into account future cash requirements and the maintenance of prudent ratios.

Refer in the chapter on Investor Relations for further details related to Investors.