- Messages

- Profiles

- Business

Model - Management Discussion

and Analysis - Stewardship

- Integrated Risk Management

- Corporate Governance

- Annual Report of the Board of Directors on the Affairs of the Bank

- Report of the Audit Committee

- Report of the Human Resources and Remuneration Committee

- Report of the Nomination and Governance Committee

- Report of the Board Integrated Risk Management Committee

- Report of the Credit Approval Committee

- Report of the Related Party Transactions Review Committee

- Directors’ Statement on Internal Control

- Independent Assurance Report

- Investor

Relations - Financial

Reports- Financial Calendar

- Statement of Directors’ Responsibilities in Relation to Financial Statements

- Chief Executive’s and Chief Financial Officer’s Statement of Responsibility

- Independent Auditors’ Report

- Income Statement

- Statement of Profit or Loss and other Comprehensive Income

- Statement of Financial Position

- Statement of Changes in Equity

- Statement of Cash Flows

- Notes to the Financial Statements

- Other Disclosures

- Supplementary

Information

Management Discussion and Analysis

Value Creation and Internal Capital Formation

Internal capital is the reciprocal value generated by the Bank and the Group – through activities, relationships, and linkages with the various stakeholders – for its own benefit. This capital consists of financial and institutional capital: financial capital is quantifiable and is represented in the Group’s financial statements, and institutional capital is represented by abstract entities such as organisational knowledge, systems and processes, corporate culture and values, brand equity, business ethics, and integrity and associated collateral. The combination of these capitals help us to deliver greater value to our stakeholders, and we strive to grow these capitals further.

FINANCIAL CAPITAL

Financial Performance

Overview

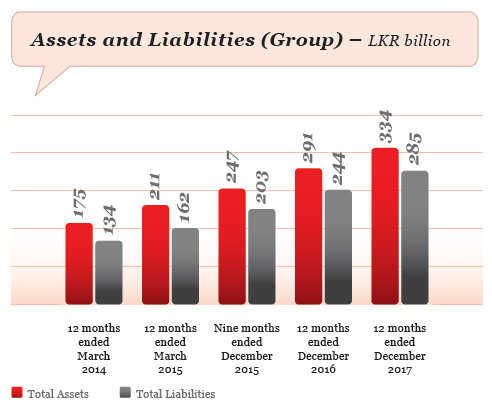

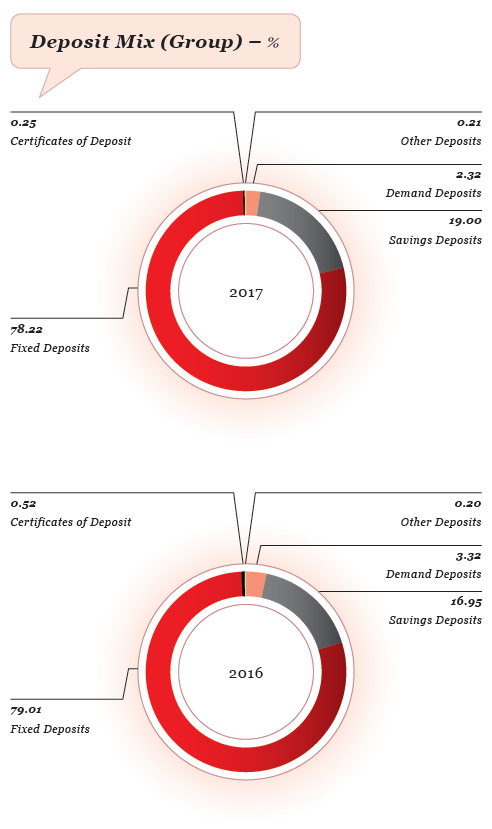

DFCC Bank ended the year 2017 accomplishing many significant milestones after completing its second year as a fully-fledged commercial bank. During the year S&P Global Ratings and Fitch Ratings Lanka Limited upgraded DFCC Bank’s outlook from “Negative” to “Stable”. Fitch Ratings affirmed the National long-term Rating AA- and S&P Global Ratings affirmed ‘B’ long-term and ‘B’ short-term credit ratings on DFCC Bank. The total asset base of the Bank grew by 15% year-on-year to LKR 333,107 million with the Loans and Receivables exceeding the LKR 200 billion mark to end at LKR 213,676 million. The deposit base improved prominently by 38% to LKR 193,308 million with CASA (Current and Savings deposits) recording a remarkable increase of 45% year-on-year. The ratio of CASA over the total deposits improved to 21.5% by end 2017. The Bank’s NPL ratio improved to 2.77% from 2.97% in 2016.

Continuing its commitment to financial inclusivity, the Bank added a branch in the Western Province and 14 extension offices were converted into fully-fledged branches during the year in line with its geographical expansion drive and achieved a total branch network of 138.

Profitability

The Bank recorded a profit before tax of LKR 5,792 million, a growth of 31% and profit after tax of LKR 4,415 million, a growth of 34%. The Group recorded a profit before tax of LKR 5,891 million, a growth of 26% and a profit after tax of LKR 4,434 million, a growth of 28%. This performance amply demonstrates the Bank’s ability to consolidate its position as a commercial bank within a short period.

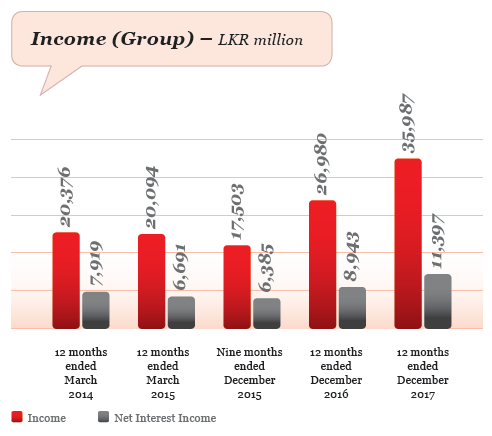

Net Interest Income

The Bank’s total income for the year 2017 recorded an increase of 34% to LKR 35,942 million. The interest income consists of 92% of the total income of the Bank. The growth of LKR 6,230 million in interest income from loans and receivables from other customers mainly contributed for this growth. The Bank’s net interest income recorded a credible growth of 27% to LKR 11,343 million from LKR 8,901 million in 2016. Interest margin increased to 3.64% from 3.32% in December 2016. This performance is commendable given the significant growth of LKR 40,231 million in fixed deposits during the year. Close monitoring of market trends and repricing of assets and liabilities at correct intervals helped to achieve this result. The total interest income grew by 36% to LKR 32,987 million. Interest expenses increased by 42% to LKR 21,644 million mainly due to 38% increase in the deposits due to other customers.

Fee and Commission Income

Growth in overall business segments, introduction of new products based on changing needs of customer profile and expanding delivery through electronic channels and other means helped the Bank to record a 22% growth in net fee and commission income. Fees generated from loans and advances and from services provided through customer accounts accounted for the majority of the increase. Fees collected from trade-related services, remittances, issue of Guarantees and Bancassurance services grew during the year. The Bank’s credit card income recorded a moderate growth. The Bank initiated the issuing of credit cards from its own system from December 2017. This move would add more value to the customer convenience and will open up considerable growth in earnings from this important business line.

Total Operating Income

Net gains from trading of forex, fixed income securities and equity trading increased by 6% to LKR 362 million.

During the year, the Bank’s swap book increased substantially due to increase (net) in foreign borrowings and foreign currency deposits during the year. The incremental premium cost due to the volume increase and marked-to-market fair value changes mainly contributed to the losses reported in both “net loss from financial instruments at fair value through profit and loss” and “other operating loss”. The increased cost is however recovered through higher interest income earned from rupee lending funded through swaps.

Net gain from financial investments recorded a substantial growth of 92% (LKR 1,073 million) mainly from the sale of 10,024,888 shares from investment of 14.7% stake in Commercial Bank of Ceylon PLC shares. The sale proceeds were used to purchase shares allotted through the rights issue. The overall positive growth in total revenue streams contributed to 25% increase in total operating income to record LKR 14,298 million from LKR 11,461 million in the year 2016.

Total Group operating income increased by 23% to LKR 14,390 million from LKR 11,717 million reported in the previous year.

Impairment Charge on Loans and Other Losses

The impairment charge for the year increased by 26% mainly from the increase in collective impairment by LKR 324 million. This increase came from the growth in loans and receivables from other customers. The specific allowance for impairment declined by 8% to LKR 724 million from LKR 792 million in the year 2016. Continuous monitoring and timely corrective measures helped the Bank to curtail overdue loans. Consequently, the Bank’s ratio of non-performing advances (NPA ratio) improved to 2.97% at the end of 2017 from 2.77% in December 2016. There was no change in the methodology adopted in computing collective impairment and specific impairment on individually significant loans during the year.

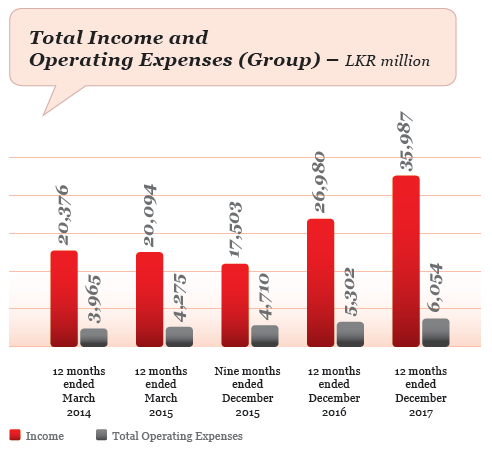

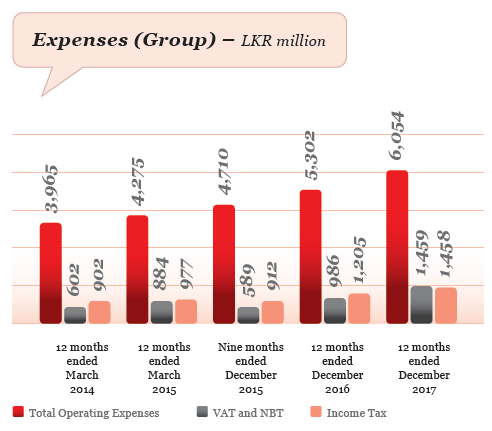

Operating Expenses

The Bank’s strategy in increasing its franchise through expansion of sales forces was aggressively adopted during the year. The increase in branch network, expansion of product base and creating multiple delivery channels through automation contributed to increase in revenue streams, deposit growth and customer base. The incremental cost that had to be incurred for the above business growth mainly contributed to 15% increase in operating expenses. However, careful monitoring and effective cost control measures adopted during the year along with additional revenues generated during the year helped the Bank to record a lower cost to income ratio of 41.1% in 2017 compared to 44.7% in the previous year.

The Group operating expenses increased by 14% to LKR 6,054 million from LKR 5,302 million in the year 2016.

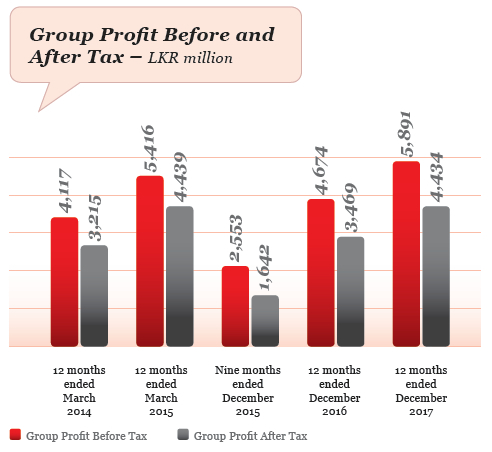

Profit Before Tax (PBT)

The profit before tax of the Bank increased by 31% for the year 2017 to record at LKR 5,792 million from LKR 4,414 million in the year 2016. The tax rate for financial VAT increased to 15% from 11% during the year 2016. When the tax increase is adjusted for the full period of 2016, the profit before tax of the Bank for the year 2017 had actually grown by 37% year-on-year. The Group profit before tax increased by 26% to LKR 5,891 million during the year 2017 from LKR 4,674 million in 2016.

Profit After Tax (PAT)

The Bank reported a profit after tax of LKR 4,415 million, a growth of 34% from LKR 3,289 million in the year 2016. The Group profit after tax attributable to equity holders of the Bank increased by 28% to LKR 4,362 million compared to LKR 3,415 million in the year 2016.

Financial Position Analysis

Assets

The Bank’s total asset base as at 31 December 2017 grew by 15% to LKR 333,107 million from LKR 290,060 million as at 31 December 2016. The growth of the asset base was accounted mainly from the growth of LKR 27,891 million in loans to other customers, LKR 9,323 million from Government bills and bonds, and LKR 5,340 million in placements with Banks. The term loans growth of LKR 12,691 million recorded the highest out of the total growth in loans and receivables from other customers, followed by overdrafts (LKR 11,089 million) and trade finance (LKR 5,051 million).

Despite regulatory constraints and increased vehicle market prices during the year, the leasing receivables (net) increased by LKR 584 million. The pawning advances had a growth of LKR 487 million during the year.

The Bank being the major contributor to the asset base, the Group total asset base increase was the same as that of the Bank.

Liabilities

The Bank was able to record a substantial growth of 38% in its deposit base during the year. This growth brought up the deposit base to LKR 193,308 million from LKR 140,514 million (2016) as at December 2017. The Bank’s loans to deposit ratio improved to 114% from 137% as a result. The Bank undertook very successful promotional campaigns on low cost deposits during the year that helped to increase its current and savings deposits (CASA) by 45%. Total CASA deposits increased by LKR 12,682 million to LKR 41,129 million compared to LKR 28,448 million as at end 2016. This improved the CASA ratio to 21.3% from 20.2% in 2016. The Bank will continue to grow this segment aggressively during 2018. Foreign currency deposits of the Bank also recorded a significant growth of 47% to LKR 41,755 million from LKR 28,346 million year-on-year.

The Bank reduced its short-term borrowings substantially during the year by growing its deposit base. Accordingly, balances due to Banks declined by 47% to LKR 9,641 million from LKR 18,104 million as at end 2016. DFCC Bank continued its approach to tap local and foreign currency related, long to medium term borrowing opportunities. This has increased other borrowings by LKR 568 million (net) during the year under review. The Bank was able to settle its Debenture of LKR 5,000 million matured during the year. This brought down the Debt securities issued by LKR 4,735 million to LKR 24,444 million from LKR 29,179 million year-on-year. Due to the increase in business volumes, Bank’s other liabilities increased by LKR 275 million (7%).

Equity and Compliance with Capital Requirements

The Bank’s total equity increased by LKR 2,027 million during the year from the addition to retained earnings.

The Bank’s profit for the year of LKR 4,415 million was lowered to LKR 3,199 million in total comprehensive income mainly due to the transfer of LKR 1,189 million from Other Comprehensive Income to Profit and Loss account on account of sale of shares in investment of Commercial Bank of Ceylon PLC (Refer Total Operating Income above). There were net gains from the change in fair value of available-for-sale financial assets and actuarial gains and losses from defined benefit plans totalling to LKR 239 million during the year.

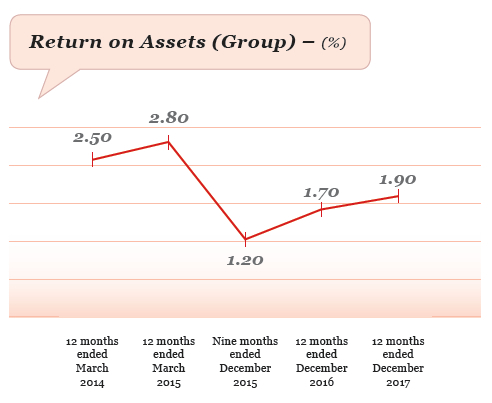

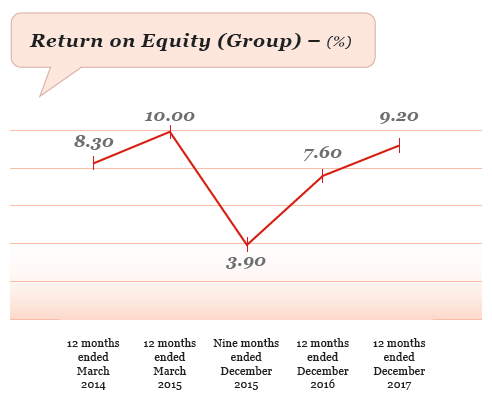

The basic earnings per ordinary share of the Bank increased by 34% to LKR 16.65 from LKR 12.41 in the year 2016. The Bank’s Return on Equity (ROE) improved to 9.4% from 7.4% in the year 2016. The Bank's Return on Assets (ROA) before tax increased to 1.9% from 1.6% in the previous year. Bank’s net asset value per share was up by 4% to LKR 180.60 from LKR 172.95 in 2016. The Group ROE increased to 9.2% during the year from 7.6% in 2016 while Group ROA improved to 1.9% from 1.7% in the previous year.

During the year, the compliance on minimum capital requirements changed from BASEL II to BASEL III with effect from 1 July 2017. This has brought up additional capital requirements through further stringent measures.

The requirement of BASEL III is phased out till 2019 commencing from Tier 1 and total capital ratios of 7.25% and 11.25% in the year 2017 to 8.50% and 12.50% in 2019 respectively. DFCC Bank achieved the current year requirements very comfortably by reporting 12.68% of Tier 1 and 16.13% of total capital as at December 2017. The Bank has planned its strategy to maintain healthy capital ratios within the next three years, in line with its business plan. Accordingly, the Board of Directors in January 2018, decided to issue LKR five to seven billion BASEL III compliant debentures subject to regulatory and other approvals to meet its future growth plans. This proposal was approved by the shareholders at the extra-ordinary general meeting held on 19 February 2018.

Credit Quality

During the year, the Bank was successful in growing its loan book covering corporate, retail and small and medium-term business segments. The expansion into new geographical areas and new customer segments increased the challenge to maintain a sustainable risk profile. The Bank improved its pre and post credit monitoring mechanisms through changes to internal processes and timely actions. This has brought positive results to improve credit quality. The Bank’s non-performing advances ratio (NPA ratio) improved to 2.77% from 2.97%. Provision cover on impaired loans computed as per accounting standard LKAS 39 improved to 78.1% from 77.2% in the previous year.

Dividend Policy

The Banking industry faced many challenges during the year; both from business and regulatory fronts. The adverse weather conditions and adverse economic conditions due to lower GDP environment that prevailed during the year became constraints for the growth of returns on equity. The minimum capital requirements became more stringent with the adoption of BASEL III. The full year impact of the 4% increase in Financial VAT rate (introduced in May 2016) was felt in the year 2017. In addition to the external factors, DFCC Bank is undergoing a growth stage consolidating its position as a fully-fledged commercial bank. The Board of Directors after considering all the above priorities has approved a dividend of LKR 5.00 per share for the year ended 31 December 2017.

Group Performance

The DFCC Group consists of DFCC Bank PLC and its subsidiaries; DFCC Consulting (Pvt) Limited, Lanka Industrial Estates Limited (LINDEL), Synapsys Limited, its joint venture company Acuity Partners (Pvt) Limited (Acuity) and its associate company National Asset Management Limited (NAMAL). LINDEL is a 31 March reporting entity while others are 31 December reporting entities. For the purpose of consolidated financials, 12 months results from 1 January to 31 December 2017 were accounted in all Group entities. Financials of 31 March entity was subject to a review by its External Auditor covering the period reported.

The Group made a profit after tax of LKR 4,434 million during the year ended 31 December 2017. This is compared to LKR 3,469 million made in the year 2016. DFCC Bank accounted for majority of the Group profit with profit after tax of LKR 4,415 million while LINDEL (LKR 146.1 million), Acuity (LKR 175.6 million) and DFCC Consulting (LKR 1.7 million) contributed positively by way of profit after tax to the Group. In the previous year, share of profit from Acuity and LINDEL reported profit after tax of LKR 149.4 million and LKR 110.7 million respectively, while DFCC Consulting made a loss of LKR 1.4 million. Synapsys, the financial technology arm of the Group reduced its loss after tax to LKR 12.5 million during the year from LKR 19.6 million in 2016. The associate company, NAMAL contributed LKR 9.4 million to the Group down from LKR 11.8 million in the year 2016. An Inter-company dividend of LKR 91.4 million was paid to DFCC Bank by LINDEL (LKR 51.4 million), NAMAL (LKR 6.8 million) and Acuity (LKR 33.2 million) during the year.

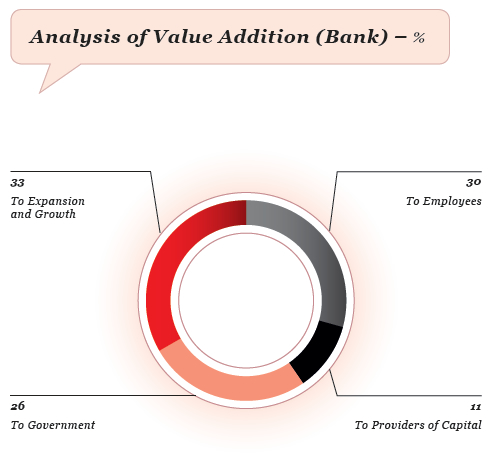

Value Added Statement – Bank

| For the year ended 31 December 2017 | For the year ended 31 December 2016 | |||||||||||

| LKR million | LKR million | % | LKR million | LKR million | % | |||||||

| Value Added | ||||||||||||

| Gross income | 35,942 | 26,754 | ||||||||||

| Cost of borrowing and support services | (23,980) | (17,277) | ||||||||||

| Impairment for loans and other losses | (1,176) | (937) | ||||||||||

| 10,787 | 8,540 | |||||||||||

| Value Allocated | ||||||||||||

| To employees | ||||||||||||

| Salaries, wages and other benefits | 3,167 | 30 | 2,809 | 33 | ||||||||

| To providers of capital | 1,193 | 11 | ||||||||||

| Dividends to shareholders | 663 | 8 | ||||||||||

| To Government | ||||||||||||

| Tax expense | 1,377 | 1,125 | ||||||||||

| Value added tax and nation building tax on financial services | 1,459 | 2,836 | 26 | 986 | 2,111 | 25 | ||||||

| To expansion and growth | ||||||||||||

| Retained Income | 3,222 | 2,626 | ||||||||||

| Depreciation | 369 | 3,591 | 33 | 331 | 2,957 | 34 | ||||||

| 10,787 | 100 | 8,540 | 100 | |||||||||

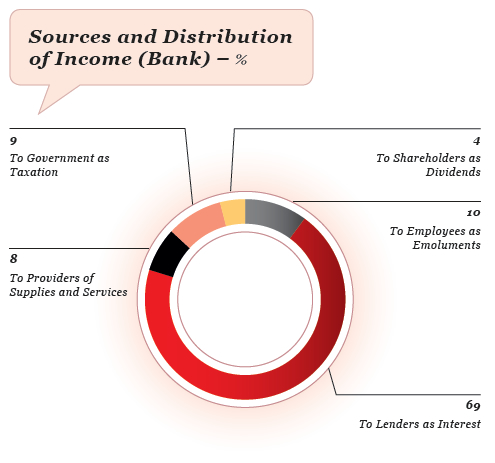

Sources and Distribution of Income – Bank

| LKR million | For the year ended 31 December | For the year ended 31 December | For the nine months ended 31 December | For the year ended 31 March | ||||||

| 2017 | 2016 | 2015 | 2015 | 2014 | ||||||

| Sources of Income | ||||||||||

| Interest income | 32,987 | 24,194 | 8,918 | 8,010 | 9,530 | |||||

| Income from investments | 2,238 | 1,165 | 641 | 2,150 | 1,211 | |||||

| Other | 717 | 1,395 | 477 | 234 | (260) | |||||

| 35,942 | 26,754 | 10,036 | 10,394 | 10,481 | ||||||

| Distribution of Income | ||||||||||

| To employees as emoluments | 3,167 | 2,809 | 1,248 | 943 | 906 | |||||

| To lenders as interest | 21,644 | 15,294 | 5,560 | 4,675 | 4,894 | |||||

| To providers of supplies and services | 2,335 | 1,983 | 913 | 587 | 576 | |||||

| To Government as taxation | 2,836 | 2,111 | 864 | 1,116 | 1,056 | |||||

| To shareholders as dividends | 1,193 | 663 | 1,591 | 1,458 | 1,325 | |||||

| Retained in the business | ||||||||||

| Depreciation set aside | 369 | 331 | 157 | 140 | 137 | |||||

| Provision for losses | 1,176 | 937 | 225 | (308) | 324 | |||||

| Reserves | 3,222 | 2,626 | (522) | 1,783 | 1,263 | |||||

| 35,942 | 26,754 | 10,036 | 10,394 | 10,481 | ||||||

DFCC Bank's Business Unit Performance

Corporate Banking

Committed to environmental and social sustainability, the Bank continued to explore new avenues in financing renewable energy projects. In 2017, the Bank granted term loans to establish two waste-to-energy projects which will generate electricity using municipal solid waste collected within the Western Province. With each project generating 10MW, a total of 1,100 MT of municipal solid waste will be consumed per day, waste which would otherwise be dumped into landfills resulting in the creation of garbage mountains and leading to events such as the Meetotamulla tragedy which resulted in the loss of human lives in April 2017. The second 10 MW ground based solar power project at Hambantota financed by the Bank was commissioned during the year. Both these projects have posted impressive operating results.

The Ceylon Electricity Board offers competitive tariffs for small scale solar photovoltaic installations under the Net Plus and Net Accounting methods, providing a lucrative opportunity for owners of large rooftops to reduce their electricity costs and generate economic returns.

Recognising this, the Bank financed rooftop solar projects of 10 MW distributed across several factory buildings during the year, and anticipates providing financial support for many more projects.

Continuing a 2016 initiative to develop a sizable offshore lending portfolio focusing on emerging markets in South Asia and East Africa, the Bank granted a US Dollar term loan facility to part finance the construction cost of a 7.6 MW mini-hydro power project in Uganda with a majority holding by Sri Lankan investors. The Bank is also in the advanced stages of negotiations on two term loan facilities for hotel companies in Maldives. The Bank will continue to actively pursue further offshore lending opportunities in East Africa and South Asia.

Performance

The Corporate Banking department recorded a portfolio growth of 12.3% during 2017 despite the year presenting a challenging operating environment. While recording this growth, the department maintained its non-performing ratio at nearly 0%. This was a testament to the prudential measures adopted in granting credit and the stringent continuous monitoring of credit facilities granted.

Future Outlook

Focus was placed on improving fee-based and transactional income to the Bank in 2017. With a state-of-the-art “Payments and Cash Management” (PCM) solution recently launched by the Bank, 2018 will see more focus on the promotion of this solution to corporate clientele, which will improve the Bank’s CASA position and fee-based income opportunities.

With customers being a core focus of the Bank, the Corporate Banking Department held several customer-centric events during the year to improve fellowship with customers, identifying their needs to better align the Bank’s products and services to the aspirations of customers.

Business Banking

Positioned in-between Branch Banking and Corporate Banking, DFCC Bank’s Business Banking combines the best of both ends of the spectrum, offering an entire range of banking services, inclusive of commercial banking counter operations and lending products. The Bank maintains a close and cordial relationship with a diverse portfolio of clients, from lower-end corporate clients and higher-end SME clients, to retail customers.

Business Banking products include:

- Project loans

- Term loans for financing of business assets and construction of commercial buildings

- Loans and overdrafts to finance working capital

- Trade finance to facilitate imports/exports

- Debenture investments

- Fee-based products such as Letters of Credit and guarantees to cover transaction-related contingencies

- Personal financial services such as credit cards, leasing, personal loans, and housing loans.

Performance

During the period under review, the Business Banking assets portfolio grew by 20.4% to LKR 26,232 million – an impressive achievement. The loan portfolio contributed significantly to the growth of the asset portfolio.

Furthermore, the Business Banking deposit base, consisting primarily of fixed deposits, grew by LKR 2,592 million. The aggregate liability base stood at LKR 13,511 million as at 31 December 2017.

The Consumer Banking Assets portfolio grew by 21.2% to LKR 1,223 million. The Business Banking Unit was the largest contributor to the overall growth of the Consumer Banking Asset portfolio of the Bank.

Future Outlook

The Business Banking Department will focus on growing the CASA base in 2018 by adopting a strategy of developing new relationships while strengthening the existing relationships.

Branch Banking

EIB SME and Green Energy Global Loan

DFCC Bank implemented the EIB SME and Green Energy Global Loan credit line in March 2014. 70% of the credit lines was allocated for SME projects and the balance 30% for renewable energy and energy efficiency projects.

The entire loan of EUR 90 million was allocated within the stipulated period. This amounted to approximately LKR 14,478 million for 171 projects (net of cancellations) from three participating intermediary banks, including DFCC Bank. During 2017, supplementary allocations were granted to existing beneficiaries to finance cost overruns and expansions of approved projects with a view of utilising additional funds made available due to prepayments and gains from foreign exchange fluctuations.

During 2017, LKR 2,128 billion was disbursed as refinance to intermediary banks for the benefits of their customers. LKR 14,533 million has been disbursed in total.

SME projects in a variety of sectors including auto services and repair, bakery products, construction, education, healthcare, manufacturing including agro-processing, printing, retailing, tourism, and trading have been funded by this credit line.

Furthermore, a total of 18 renewable energy-based power generation projects with 56.7 MW of total planned capacity via solar, wind, bio-mass, and mini-hydro technologies were financed by the credit line. By year end, a total of 16 projects with a capacity of 53.7 MW were operational.

|

34.2% Profit Growth (Bank) |

||

| 2.77% NPL (Bank) |

||

| 14.8% Asset Growth (Bank) |

||

| 34.3% Income Growth (Bank) |

||

| 16.13% Total Capital Ratio (Bank) |

Commercial Lending

The Bank’s six decades of experience in development financing contributed positively towards increasing the project loan portfolio in 2017. Branch Banking actively participated in many concessionary loan schemes including EIB, SMILE III (RF), SMELoC, Saubhagya, Jaya Isuru, and Ran Aswenna. Loans and leases worth over LKR 3,800 million were granted through concessionary loan schemes covering key development sectors in Sri Lanka during the year. Active efforts will be taken to promote the Environmental Friendly Solution Fund II (E-friends II) revolving loan scheme that was established during the latter part of 2017 through the branch network to facilitate enterprises to comply with environmental standards and encourage pollution control and resource recovery initiatives.

Performance

Branch Banking recorded an overall asset growth of 15% in 2017, with 17% of growth in commercial lending.

In the face of stiff competition, Branch Banking was able to increase the overall liability portfolio by 35% while maintaining the CASA at 25%.

The credit portfolio remained healthy, in spite of the slow growth in the economy and natural disasters experienced during the year. This was the result of the Branch Banking Unit taking a proactive stance towards follow-up and recovery procedures adopted during the year.

Future Outlook

The primary focus in 2018 will be on increasing the customer base of the Bank, with a particular focus on retail clients that will pave the way to grow the CASA and retail lending portfolios.

Facility processing and recovery will be improved in regional offices and central units, which will aid branch teams in becoming more customer-centric.

To ensure continuous improvement of the Bank’s retail portfolio, a Central Collection Unit will be established to drive delinquency management and early collections.

Personal Financial Services/Consumer Banking

The Consumer Banking Unit aims to provide seamless banking solutions for the individual client. An individual can avail an entire range of flexible financial solutions catering to their needs, including personal loans, housing loans to purchase, build, or buy one’s own home or apartment, vehicle loans and leasing, and educational loans and advances.

Consumer Banking also offers a host of attractive deposit products catering to the entire family, from newborn to senior citizen. Individual customers can benefit from the DFCC Virtual Wallet, a revolutionary breakthrough in digital payments that offers retail customers a hassle-free and convenient option to manage their funds eliminating the need to carry other payment instruments.

Liabilities

Consumer Banking CASA saw a major push in 2017, with the desired results achieved through branch expansion and new initiatives rolled out throughout the year. Aggressive campaigns aimed at instilling the habit of saving as a family unit were carried out across the branch network. Starting in January, a family savings campaign was launched, rewarding entire families that saved together. Families were rewarded with exciting gifts in April for the New Year and at the end of the year, in keeping with the spirit of the season. The drive to increase the number of accounts culminated in a marked improvement, achieving 200% year-on-year growth, primarily through branches out of Colombo.

“Vardhana Junior”, the Bank’s savings product for minors, was re-launched in July 2017 with an array of exciting gifts for children. Campaigns were carried out at schools, hospitals, and other locations across the island to raise awareness of the product. The product recorded a growth of 28% for the year, exceeding targets.

DFCC Bank continued to offer various savings products around the year, coupled with attractive interest rates and rewards on products such as Xtreme Saver, Mega Bonus, and Supreme Vaasi. The Xtreme Saver product emerged the star performer.

Performance

Consumer Banking liabilities grew by 30%, marking an excellent year. Time deposits grew by 36% and CASA grew by 12%, the two largest contributors to liability growth.

The overall liability performance was well above target, with the majority of growth experienced in Colombo and its suburbs, the Southern Central and North Central regions also recorded strong growth.

Future Outlook

DFCC will continue its efforts to grow the CASA in 2018, with several developments in the works, innovations backed by cutting-edge technology and investments in new channels of delivery apart from brick and mortar. Although catering to the future generation will be a challenging task, the Bank is fully geared to face the future head on, offering a breadth of seamless banking solutions that give customers unmatched value and unique benefits.

Consumer Assets

DFCC Consumer Assets is a relatively new entrant into the arena taking off in 2016 with DFCC Bank positioning itself as a fully-fledged commercial bank. 2017 witnessed a steady growth with the portfolio recording a 10% growth closing at LKR 35,000 million.

Much emphasis is placed on the growth of the Bank’s retail portfolio considering the challenges faced in the industry with diminishing margins on interest. Furthermore, retail banking also plays a predominant role in contributing to the CASA growth of the Bank. 2017 witnessed an aggressive drive in obtaining employee pay roles while extending flexible and competitive employee banking solutions.

During the year 2017, new developments in products and processes took place, offering the individual customer a host of innovative offerings. In a bid to attract fixed income earners, employee banking solutions were actively marketed across the branch network. The increase in reach brought in new opportunities and many campaigns targeting specific segments were carried out which contributed to achieving the desired outcome. DFCC Bank’s team of dedicated Business Development Officers continued to serve customers at their doorstep thereby ensuring that they received the very best of service.

Performance

On analysing the retail lending portfolio, 74% of the base attributes to regions out of Colombo. The year 2017 also witnessed majority of the growth taking place out of Colombo.

Future Outlook

Consumer assets will continue to play a key role in 2018. A continued investment in technology will result in a dynamic and innovative digital strategy across operations, driving the Bank towards an era of online applications, transactions, and processing. Value addition and customer care will be the focus of further investment going forward, with the Bank focused on adding broader and more diversified products. The Bank will continue to expand the branch network and increase its brand presence, particularly in key rural areas and up-and-coming towns across the country with potential for growth in consumer banking.

Housing

Marketed as part of the total Consumer Banking Solution, our housing product targets a wide cross-section of demographic comprising executives, professionals, private and public sector employees, and entrepreneurs. Growth was significant in fast developing urban areas and regions out of Colombo, due to the expansion of the branch network. Target growth was enabled through a number of campaigns aimed at specific segments.

The surge in high-rise buildings in the skyline of Colombo has opened up many opportunities for home loans, for the Bank to capitalise on – it entered into tripartite agreements with a number of reputed developers. The loan book saw significant contributions as a result of the Bank successfully catering to the high net-worth and middle income segments in apartment financing. Dual citizens and citizens employed abroad also benefited from the housing loans. Borrowers were offered complementary fire insurance policies on housing loans, in addition to attractive pricing.

Performance

The housing loan portfolio recorded a substantial growth of 20% in 2017. Offering a tailor-made product to build, buy, renovate, or improve one’s home, Sandella Housing loans also covers the purchase of land and condominiums.

Leasing

A pioneer in the Leasing industry, DFCC boasts of a proud heritage of contributing to the development of the nation. Since 1984, DFCC Leasing has provided leasing solutions that cater to both SMEs and individuals.

DFCC Bank continued to offer machinery leasing, contributing to the growth of the SME sector. To cater to demand for commercial vehicle leasing, the Bank entered into strategic tie-ups with leading brands such as Tata from DIMO, Fuso and Mitsubishi from United Motors during the year. Apart from competitive interest rates, the Bank’s team of Business Development Officers continues to service customers at their doorstep.

Performance

2017 proved to be a challenging year for leasing, with the Government having mandated tighter loan-to-value ratios and other regulatory measures. Despite the tougher climate, the leasing book recorded a growth of 4% with substantial disbursements. Growth was spurred primarily from Western province, with equally strong growth in the North Western and Southern regions.

Personal Loans

Personal loan products were used as a tool in a pull strategy to stimulate growth of the Bank’s salary account base and Employee Banking solutions. Packages were crafted to suit various fixed income segments and a cross section of demographics covering lower, middle, upper middle, and high income categories in private and Government service.

The year saw the launch of a new product, “Vardhana Double Winner”, offering a personal loan coupled with an overdraft to provide customers with access to credit in case of an emergency.

Performance

Competitive pricing and process improvements resulted in the product growing by 13%.

Future Outlook

Personal loans will be used increasingly going forward to grow the Bank’s CASA base, with a primary focus on fixed income earners.

Gold-pledged Lending

Pawning products continued to grow during the year, as it proved to be an easily accessible and convenient source of emergency funding.

Performance

Strong demand for the product was recorded mainly out of Colombo, with substantial growth in the North.

Future Outlook

Coupled with a high advance value and an excellent service, the growth momentum is expected to continue into 2018.

Card Operations

The DFCC Bank credit and debit cards offer customers access to over 37 million merchants worldwide and accessibility to over three million ATMs worldwide.

Having obtained principle membership status with Visa International in 2016, the Bank continued to invest in the card business in 2017. A new credit card management system was implemented in November 2017, the first of its kind to be developed locally on a par with the highest international standards, as approved by Visa International. With the implementation of the new system, the Bank has setup the business model for cards to grow in 2018.

DFCC credit card holders were offered attractive discounts at leading merchant stores during the Christmas season. Users continue to enjoy discounts around the year and value added services, such as “loan oncard” which allows customers to obtain cash up to 75% of their credit limit, and a balance transfer facility with the lowest rates in the market. Flexi plans offer customers more convenient ways to better manage their finances for purchases over LKR 10,000 and the flexibility to repay via up to 24 month installment plans.

In line with its customer focus, DFCC Bank established connectivity with the common ATM switch through LankaPay, allowing DFCC customers to access their account through over 3,600 ATMs locally. Common Electronic Fund Transfers (CEFT) were also enabled for credit card payments in January 2018.

The Bank also offers customers the Multi Currency Global Travel card in its product portfolio, a prepaid card which enables pre-loading and access to four international currencies in one card at any given time. The product can help customers to significantly reduce the costs that arise from multiple currency conversions.

With the assistance of a global processor since the third quarter of 2015, the Bank provided a credit card acceptance technology to merchants. As at the end of 2017, over 300 merchant establishments have been equipped with the card acceptance technology.

Performance

During 2017, the Bank reported a total of over 148,000 debit cards with 35,000 new cards being issued. Debit card usage stood at LKR 4,600 million, representing 126,000 ATM transactions, and LKR 830 million from 325,000 POS terminal transactions.

The aggregate credit exposure of the credit card portfolio stood at LKR 880 million as at 31 December 2017, representing a card usage of LKR 485 million.

Despite the Bank’s late entry into the market, the credit cards operations remain a viable business line. The prudent screening methods employed by the Bank in the issuance of credit cards has kept the card portfolio free of material mismatches.

Future Outlook

The Bank will continue to invest in the growth of the cards business and aims to launch new credit card products in 2018. EMV chip technology for debit cards and contactless credit cards are to be introduced in 2018 to provide enhanced security and ease of access for DFCC cardholders.

Premier Banking

DFCC Bank commenced Premier Banking operations in 2012, aimed at clients who maintain deposits or advances of over LKR five million or an equivalent amount in foreign currency. In addition to providing a speedy and reliable service that the Bank provides to all its clients, this elite membership is offered a wide array of products and services.

The Premier Banking clientele comprises of high net-worth individuals based both in Sri Lanka and abroad. The knowledge and expertise of the entire group is leveraged towards maximising the return on investments, while adhering to the risk appetite of the diverse range of clients. Understanding the busy lifestyle of premier clients and their demand for a superior level of service, a dedicated Relationship Manager is assigned to serve each of them.

Continuing to stay ahead of the competition and leverage on information technology in pursuit of developing the Bank’s relationship with its clients, the Bank launched the “Premier Go” app, an industry first. Through this app, clients can connect with their dedicated Relationship Managers anywhere in the world, be updated on current promotions and offers, view account balances, schedule appointments, and keep track of their finances.

The revamp of the Premier proposition saw the Margin Trading product being revived with changes made to the marginable stocks and relaunched to suit the needs of equity investors. The product was demonstrated amongst the stockbroking community at a stockbroker function held to promote the product. Premier clients were offered complimentary invites and tickets for exclusive events around the year, such as the Annual Sri Lanka Directors’ Dinner organised by the Sri Lanka Institute of Directors, and stage plays of veteran playwright-cum-actors. DFCC Bank was also proud to sponsor the Inter School Golf Tournament hosted by the Royal Colombo Golf Club in 2017.

Performance

The premier customer base increased by 45%, which led to a deposit growth of 45% and advances growth of 80% on a year-on-year basis in 2017.

Institutional Business and Product Development Unit

Formed in January 2017, the objective of the Institutional Business and Product Development Unit is to drive business among institutional clients (non-individual) and carry out product development initiatives across the Bank in a focused and structured manner. The Unit’s work scope is built under the following pillars:

(a) Institutional deposits

(b) Trade business

(c) Product development

Institutional Deposits

Due to DFCC’s strength traditionally being in lending, the Unit had a challenge to lead a shift in mindset across the Bank to move towards deposits. To achieve this objective, a series of both internally and externally focused strategies and projects were planned and rolled out around the year.

Performance

This resulted in the Bank growing its overall institutional deposits to LKR 34,336 million as of 31 December 2017 from LKR 23,859 million as of 31 December 2016, an unprecedented year-on-year growth of 44%. The high importance given to CASA mobilisation enabled institutional CASA deposits to grow by LKR 1,627 million during the year, to LKR 8,256 million as at 31 December 2017 from LKR 6,629 million as of 31 December 2016. An institutional CASA ratio of 24% was achieved as of 31 December 2017.

Trade Business

The Institutional Business Unit was tasked with driving Branch Banking trade business and contributing towards boosting trade fees and commission income. Through the identification of critical success factors, a multi-dimensional business model was developed and a series of carefully planned initiatives rolled out with clear timelines under central supervision. A team was handpicked to execute the strategies at ground level and provided with technical training and business skill coaching. Effective mechanisms for close central monitoring and follow-up were introduced to ensure delivery of action plans.

Performance

As a result of the integrated approach, Branch Banking import limits achieved a growth of over 52% within a time period of approximately six months while achieving extremely high levels of utilisation. Healthy growth in export limits was also seen while utilisation remained consistently high. Large scale personal visit campaigns aimed at key trade client segments helped in penetrating previously untapped segments.

Product Development

Set up in January 2017, the objective of the Product Development (PD) Unit is to ensure the Bank offers attractive and unique products to suit the constantly changing market. It does so by taking responsibility for bringing multiple internal stakeholders together as part of the product development exercise at any stage, be it idea initiation, development, execution, or analysis. In its first year, the Unit was able to launch and revamp several products and campaigns, while complying with the Bank’s Product Development Policy.

A successful CASA building campaign, the Avurudu hat-trick, was carried out in April. A follow-up campaign was carried out in October, in view of the Thrift Month.

“Vardhana Junior” a savings product for minors, was relaunched in July and stood out from competitor offerings as the most attractive savings product for minors. The relaunched product offered attractive gifts and introduced a unique rewards scheme aimed at Grade 5 scholarship students.

In partnership with WebXpay, a new product proposition was launched to offer mutual business clients unique cost-effective m-Commerce solutions and financial services to enable them to launch and carry out their businesses online.

Supporting the Bank’s vision of achieving one million customers by 2020, an internal campaign, “Road to a Million Customers”, was launched between October and December 2017, helping to increase the client base significantly, encouraging staff members to serve as proud brand ambassadors for DFCC.

As part of its efforts to strengthen the Bank’s CASA products with additional features, PD introduced Life and Hospitalisation Covers for customers who saved with DFCC during the festive season. The Unit will continue this momentum by introducing many more unique offerings to the market, ensuring that the Bank and its customers will “Keep Growing”.

Treasury

The Treasury Front Office (TFO) of DFCC Bank consists of three main income generating units: the Foreign Exchange and Money Markets Unit, the Fixed Income Unit, and the Treasury Sales Unit that report directly to the Head of Treasury.

The Treasury Middle Office (TMO), functioning independently under the purview of the Chief Risk Officer (CRO) monitors the risks assumed by the Front Office based on Board-approved limits and controls. TMO operations were further enhanced during the period under review in line with the regulatory guidelines.

The Treasury Back Office (TBO) is accountable for the preparation, verification, authorisation, and settlement of all transactions made by the TFO. The TBO independently reports to the Head of Finance/Chief Financial Officer, in compliance with regulatory guidelines.

During the period under review, the Standard Deposit Facility (SDF) and Standard Lending Facility (SLF) rates of the Central Bank of Sri Lanka (CBSL) were revised upwardly by 25 bp to end the year at 7.25% and 8.75% respectively. This is in line with the tightening cycle adopted by the regulator since the end of 2015. No further upward revisions to the rates are expected during the first half of 2018.

The country’s economic achievements have been recognised by rating agencies Fitch and Standard & Poor, where both upgraded the country’s outlook to “stable” from “negative”. The rating agencies anticipate the Government will maintain the reform momentum over the next 12 months and manage the debt redemptions efficiently.

The US Federal Reserve raised their target rate thrice in 2017, leaving the rate at a range of 1.25% to 1.50%.

With surplus liquidity in the market during the second half of the year, the interbank money market rates (overnight rates) continued to slide to close the year at 8.15%, compared to 8.42% at the start of the year. Closing market liquidity was around LKR 9,700 million. Risk-free Treasury Bill and Bond yields also followed suit, particularly during the second half of the year. It is noted that the one year Treasury Bill rates stood at 8.90% compared to 10.22%, while five year and ten year Bonds reduced to 9.60% from 11.90% and to 11.00% from 12.50% by the end of the year.

The Dollar-Rupee market was fairly stable during the year due to the CBSL allowing market forces to seek its equilibrium. The YTD depreciation in LKR has been limited to 2.35% in the backdrop of strong inflows to the equity and bond markets, particularly since the second quarter of the year. Improved foreign investor appetite in the region and domestic developments added to the positive momentum. The country witnessed foreign inflows to the debt and equity markets of LKR 64,178 million and LKR 17,654 million respectively. Stability in the currency markets was boosted by the successful completion of Sovereign Bond issuance by the Government of Sri Lanka in May 2017 where the Government successfully raised USD 1.5 billion through a ten year sovereign bond with a final order book exceeding USD 11.5 billion. This resulted in higher foreign exchange (FX) reserves.

The IMF standby facility helped to add confidence to investors seeking economic stability as a precursor for investing in the country. Improved export earnings partly contributed to the regained GSP+ benefits, and a robust tourism sector are other factors that contributed to increased confidence in the country. The commendable performances in these sectors have managed to offset the negative impact of declining worker remittances to the country.

The less volatile and predictable currency movement in LKR has helped the banks to better manage their foreign exchange risk while quoting the customers very attractive exchange rates on their transactions as a result of the reduction of the risk premiums. This would also help to improve appetite of the foreign investors of the country as they can now project the future returns more accurately.

Performance

The Treasury Fixed Income (FI) desk made major gains during the year through trading activities while contributing considerable interest income to the bottom line. Given the lack of opportunities in the market, these are significant achievements. The FI portfolio stood at LKR 55,990 million while the encumbered portfolio (reserved for repurchase agreement transactions) stood at LKR 5,640 million at the end of the year.

DFCC Bank’s Treasury recorded LKR 270.39 million through FX trading activities while also reducing the cost of funds through its FX swap operation.

Future Outlook

With customer service in mind, the Treasury will move forward to engage in a series of process improvements with the support of the IT department. With the focus being on upgrading the existing treasury system to a new system, the department will be able to handle the increasing workload while improving overall efficiency.

Resource Mobilisation Unit

The Resource Mobilisation Unit falls under the direct purview of the Head of Treasury. It manages all term funding of the Bank, including inter alia, credit lines, syndicated loans and local and international debt issuance. The Unit coordinates with rating agencies in their reviews and works to secure ratings for debt issuances. The Unit also manages the Bank’s equity and Unit Trust portfolios, related strategic and non-strategic investments and divestments.

DFCC Bank’s Investment Portfolio

As at 31 December 2017, the combined cost of investments in DFCC Bank’s holdings of quoted shares [excluding the investment in the voting shares of Commercial Bank of Ceylon (CBC) PLC], unquoted shares, and unit holdings amounted to LKR 1,470.61 million.

The composition of the investment portfolio is detailed as follows:

Investment Portfolio as at 31 December 2017

| Cost (LKR million) | Market value (LKR million) | |||

| Quoted share portfolio (excluding CBC voting) | 715.48 | 928.72 | ||

| Unit trust portfolio | 669.58 | 838.95 | ||

| Unquoted share portfolio | 85.55 | 85.55 | ||

| Total | 1,470.61 | 1,853.22 |

The cost of the unquoted share portfolio is carried at cost on the balance sheet. The market value of the holding in the voting shares in CBC was LKR 17,262.50 million as at the end of December 2017, against a cost of LKR 4,866.53 million. During the year, the Bank made an investment of LKR 1,413.82 million in CBC rights issue to purchase the rights entitlement and made an additional LKR 113.6 million investment to purchase one million additional rights. During the same period, the Bank divested 10.79 million shares of Commercial Bank and realised of LKR 1,091.50 million as capital gains.

Additionally, the Bank divested a part of other quoted, unquoted shares, investments in unit trusts and realised LKR 77.33 million as capital gains. During the period under review, the Bank also made new investments in quoted shares to the value of LKR 17.85 million.

Bancassurance

Since its inception in mid-2014, Bancassurance operations have continued to grow. The life insurance business in particular has experienced significant growth since its streamlining exercise conducted at the end of 2016, with the signing of a long-term agreement with AIA Insurance Lanka PLC. The result is a dynamic product and service offering for the Bank’s customer base.

Loan and lease customers benefited from insurance advisory, rates, and claim settlements through the Centralised General Insurance Operation, part of the DFCC Bancassurance operation.

The Bancassurance Unit hosted many events and programmes around the year to raise customer awareness about the mitigation of risks associated with business and life. Customers were educated about financial planning and retirement planning, and received advice on planning for their children’s higher education needs.

Performance

The Bancassurance business made a noteworthy contribution to the Bank's bottom line, with high potential for future growth.

Future Outlook

Protecting its customer base from all possible risks objective associated in business and life is the underlying motive of DFCC’s Bancassurance business. To that end, the Bank continues to work to introduce new products adhering to international standards and quality.

International Banking

Trade Services

Sri Lanka’s exports hit a record USD 11.36 million in 2017, a 10% growth over 2016. Imports grew by USD 18,931 million, a growth of 9% over 2016.

After the Budget proposal in the last quarter of 2017, the Bank experienced a substantial increase in the issuance of Letters of Credit related to vehicle imports.

Over the course of the year, the Bank was able to take on new trade clients via the branch network and the coordination between the Business Banking and Corporate Banking units. The Bank established a separate trade unit at the Pettah Main Street branch to improve the speed and quality of its service to its trade clients.

Through the improvement of processes to cater to customer requirements, the expansion of the correspondent banking network, along with a dedicated and knowledgeable trade team, the Bank was able to grow its trade client base and improve repeat business in 2017.

Performance

The Bank’s import and export volumes in 2017 grew 13.1% over the previous year.

During the year, the interest income earned from import and export loans increased to LKR 2,469 million from LKR 1,728 million while fee and commission income increased to LKR 399.9 million from LKR 378.04 million.

Payments and Settlements

As part of the Bank’s endeavour to rationalise operational processes, a dedicated unit for Payments and Settlements was set up at the outset of 2017. This department caters to the Bank’s customer base island-wide, and handles remittances for foreign currency payments and receipts, and Domestic Payment Services (DPS) for Rupee transactions.

Domestic Payments Services is responsible for the Customers Cheque Clearing, Sri Lanka Inter-Bank Payment Systems (SLIPS), and Common Electronic Fund Transfer Switch (CEFTS) payments of the Bank.

The Remittances Department is accountable for Inward and Outward Telegraphic Transfers, Demand Draft Issuance and Collections, and is also responsible for all bill settlements of the Trade Services Division.

This specialisation approach has encouraged the staff to work together as a dedicated unit, ensuring accuracy and undertaking many precautionary measures to ensure the safety of the Bank’s customers foreign currency payments, which can be susceptible to cyber crime.

Future Outlook

Even though many sophisticated electronic funds transfer mechanisms are in place now, the Bank experienced an approximate volume increase of around 5% in the cheque clearing process during 2017. In recognition of this, the Bank will be introducing a more efficient cheque clearing system during the first quarter of 2018, enhancing service standards in the Domestic Payments sphere.

The increase in business volumes during the year were not up to expectations. In 2018, the team is determined to drive towards budgets with the help of the branches, while capitalising on the ease of doing business with the introduction of the new Foreign Currency Act.