- Messages

- Profiles

- Business

Model - Management Discussion

and Analysis - Stewardship

- Integrated Risk Management

- Corporate Governance

- Annual Report of the Board of Directors on the Affairs of the Bank

- Report of the Audit Committee

- Report of the Human Resources and Remuneration Committee

- Report of the Nomination and Governance Committee

- Report of the Board Integrated Risk Management Committee

- Report of the Credit Approval Committee

- Report of the Related Party Transactions Review Committee

- Directors’ Statement on Internal Control

- Independent Assurance Report

- Investor

Relations - Financial

Reports- Financial Calendar

- Statement of Directors’ Responsibilities in Relation to Financial Statements

- Chief Executive’s and Chief Financial Officer’s Statement of Responsibility

- Independent Auditors’ Report

- Income Statement

- Statement of Profit or Loss and other Comprehensive Income

- Statement of Financial Position

- Statement of Changes in Equity

- Statement of Cash Flows

- Notes to the Financial Statements

- Other Disclosures

- Supplementary

Information

Management Discussion and Analysis

Value Creation and External Capital Formation

CUSTOMER CAPITAL

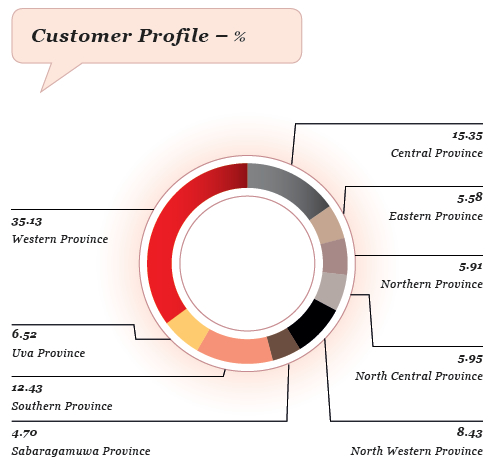

Customer Profile

The expansion of the branch network was particularly concentrated in the Southern and Western provinces. The growth of the customer base in these provinces can be attributed to DFCC Bank’s expansion in these areas, combined with promotional efforts and compelling products and services.

Our Portfolio

Corporate Banking, Branch and SME Banking, Small Business Enterprise Banking, Business Banking, Consumer Banking, Premier Banking, Treasury, and International Banking are the Bank’s primary lines of business. These business lines are complemented by the Bank’s subsidiaries, a joint venture and an associate company for services in consultancy, industrial estate management, information technology, investment banking and fund management.

Through its growing island-wide branch network, the Bank offers a full range of development and commercial banking solutions.

| 35,000 new debit cards issued |

||

| Branch Banking recorded an overall asset growth of 15% in 2017, with 17% of growth in commercial lending |

||

| 12.3% Corporate Banking portfolio growth |

||

| 20% growth in housing loans |

| Product/Service | Target Segment | |

| Project loans funded by credit lines Saubhagya |

Small and Medium Enterprises (SMEs) | |

| New Comprehensive Rural Credit Scheme | Short-term cultivation | |

| Self-employment Promotion Initiative Loan Scheme | Vocational qualification holders | |

| SMILE III Revolving Fund | SMEs | |

| Commercial Scale Dairy Development Loan Scheme (CSDDLS) | Dairy sector | |

| Small and Medium Sized Enterprises Line of Credit (SMELoC) | SMEs | |

| Swashakthi (Micro and Small Enterprises Development Loan Scheme) | Micro and Small Enterprises | |

| Loan Scheme for Resumption of Economic Activities affected by Disasters (READ) | For self-employed and small-scale businessmen to resume any economic activity affected by a disaster which has been recognised and informed by the Government of Sri Lanka (GOSL) | |

| E-friends II Revolving Fund | SMEs | |

| Jaya Isura | SMEs | |

| Ran Aswenna | SMEs | |

| Govi Nawodaya | SMEs | |

| Rivi Bala Savi | Households that willing to purchase solar panels | |

| Other project loans Term loans |

Corporates, SMEs, professionals and individuals | |

Working capital financing

|

Current account holders, corporates, SMEs, and entrepreneurs Corporates, SMEs and entrepreneurs | |

| Vardhana Sahaya A one-stop financial solution offering loans, leases, bank guarantees and other commercial facilities for MSMEs |

MSMEs | |

| Leasing facilities “Easy Leasing” facilities for brand new and unregistered/registered vehicles, machinery, plant and equipment |

Corporates, SMEs, entrepreneurs, professionals and individuals | |

| Hire purchase facilities Hire purchase facilities for vehicles |

Corporates, SMEs, entrepreneurs, professionals and individuals | |

| Guarantee facilities Bid bonds, advance payment bonds, performance bonds, bank guarantees for credit purchase of goods |

Corporates, SMEs, entrepreneurs, professionals and individuals | |

| Time deposits A wide range of tailor-made time deposit products at competitive interest rates |

Corporates, SMEs and individuals | |

| Loan syndication Loans provided by a group of lenders which is structured, arranged and administered by one or several banks |

Corporates | |

| Consultancy and advisory services Provision of legal, tax, finance, market and other advisory services to start up a new business or revamp existing businesses |

Corporates, SMEs and entrepreneurs | |

| Savings facilities Supreme Vaasi – Offers a superior rate of interest |

Businesses and individuals aged 18 years and above | |

| Mega Bonus – Interest rates grow in tandem with the savings deposits | Businesses and individuals aged 18 years and above | |

| Xtreme Saver – Offers the highest interest rate for Rupee and Dollar denominated savings based on the account balance | Businesses and individuals aged 18 years and above | |

| Vardhana Junior – Children’s savings account offering a range of gifts and support for higher education | Children below 18 years of age | |

| Vardhana Junior Plus – Children’s savings account with a higher interest rate | Children below 18 years of age | |

| Vardhana Garusaru – Offers an attractive interest rate with a range of other benefits | Senior citizens above 55 years of age | |

| Personal loans Loans that help meet personal financing requirements |

Self-employed individuals, professionals and salaried individuals | |

| Salary Booster Overdraft facility that allows an advance of up to 90% of a month’s salary |

Salaried individuals | |

| Pawning services Ranwarama Pawning – Gold-pledged advances |

Mass market/individuals | |

| Housing loans Sandella – Flexible and convenient housing loans at affordable rates |

Self-employed individuals, professionals and salaried individuals | |

| Education loans Vardhana Nenasa – Flexible and convenient loan facilities for higher education |

Individuals pursuing higher studies | |

| Other facilities Includes a range of products and services such as current accounts, overdraft facilities, foreign currency accounts, credit card facilities, DFCC Virtual Wallet, DFCC iconnect (Payment and Cash Management) gift certificates, international trade services, off-shore banking, international payments, Bancassurance, foreign money transfer via Western Union/Lanka Money Transfer and local payments. |

Business community, entrepreneurs, professionals and individuals |

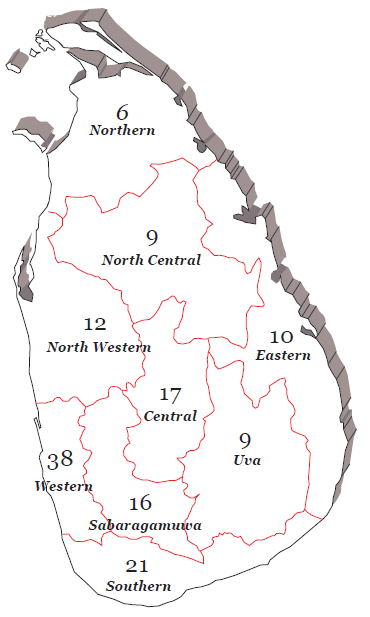

Branch Network and Service Delivery

The Bank continued to expand its branch network in 2017, with a new branch in Western province, and 14 extension offices converted into fully-fledged branches. With the opening of a second branch in Pettah, the Bank grew its presence in a busy commercial centre with great business potential. Moreover, customers can access the Bank’s services through 36 service points at Sri Lanka Post outlets and over 3,600 ATMs across the country. The Bank continues to use technology to expand its reach to customers beyond traditional brick and mortar, through Internet and mobile banking services.

Akkaraipattu

No. 78, Main Street, Akkraipattu

067-2278497 / 067-2278487

Akuressa

No. 24, Deniyaya Road, Akuressa

041-2284912/14

Ambalangoda

No. 26B, Galle Road, Ambalangoda

0912255965/0912255966

Ambalantota

No. 94, Main Street, Ambalantota

047-2225300 / 047-2225588

Anuradhapura

No. 249, Maithripala Senanayake Mawatha, Anuradhapura

025-2223417

Ampara

No. 03, D.S. Senanayake Street, Ampara

063-2224242

Aralaganwila

No. 290, New Town, Aralaganwila

027 - 2257225/027 - 2257330

Avissawella

No. 27 / 29, Yatiyanthota Road, Awissawella

0362233900

Bandaragama

No. 63/1, Kaluthara Road, Bandaragama

038-2290788 / 038-2288536

Baddegama

No. 73, Galle Road, Udakubura, Baddegama

091-2292266 / 091-2294400 / 091 - 2294401

Badulla

No. 14, Udhayaraja Mawatha, Badulla

055-2230160-2

Bandarawela

No. 126, Main Street, Bandarawela

057-2224849-52

Bandaranayake

No. 214, Srimath Bandaranayake Mw, Colombo 12

011-2438500 / 1

Borella

No. 14, Cotta Road, Colombo 08

011-2690069

Balangoda

No. 115, Barnes Ratwatta Mawatha, Balangoda

045-2288822 / 045-2286545

Baticaloa

No. 105, Trinco Road, Batticaloa

065-2228111/065-2228333

CITY BRANCH

No. 73/5, Galle Road, Colombo 03

011-2442442

CHILAW

No. 44, Kurunegala Road, Chilaw

032-2220236 / 7

CHUNNAKAM

No 122, Sir Ponnambalam Ramanathan Road,Chunnakam

021-2242145

Dambulla

671, 671B, Anuradhapura Road, Dambulla

0662283553 / 4

Dankotuwa

No. 36, Pannala Road, Dankotuwa

031-2261133 / 031- 2265744

Deniyaya

No. 04, Pallegama Road, Deniyaya

041-2273073 / 4

Dehiattakandiya

No. A 32, New Town, Dehiattakandiya

0272250373 / 0272250427

Digana

No. 19, New Town, Digana, Rajawella

081-2375486 / 7

Eheliyagoda

No. 13, Main Street, Eheliyagoda

0362258144/0362257354

Elpitiya

No. 38, Main Street, Elpitiya

091-2291866 / 7

Embilipitiya

No. 202, Rasika Building, Pallegama, Embilipitiya

047-2261369/ 70

Galle

No. 93, Wackwella Road, Galle

091-2227372 / 6

Galewela

No 6, Matale Road, Galewela

066-2287375 / 066-2287222

Gampaha

No. 123, Baudhdhaloka Mawatha, Gampaha

033-2226104

Gampola

No. 73, Nuwara-Eliya Road, Gampola

081-2350876 / 7

Gangodawila/delkanda

No. 601/1, High Level Road, Gangodawila, Nugegoda

011-2442711 / 2

Giriulla

No. 23, Main Street, Giriulla

037-2288055

Hambantota

No. 21, Jail Street, Hambantota

047-2222858

Hatton

No.01, Side Street, Hatton

051-2225799 / 051-2225589

Head office*

No.73, W.A.D Ramanayake Mawatha, Colombo 02

011-2310500 / 011-2371371

Hingurakoda

No. 88, D S Senanayake Street, Hingurakgoda

027-2245399/027-2245073

Hikkaduwa

No. 249, Galle Road, Hikkaduwa

091-2275899, 091-2276920

Horana

No. 49, Panadura Road, Horana

034-2265331 / 2

IBBAGAMUWA

No 127, Dambulla Road,Dehelgamuwa, Ibbagamuwa.

037-2259360 / 037-2258680

JAFFNA

No. 141, K.K.S Road, Jaffna

021-2221444

JA-ELA

No. 170B, Colombo Road, Ja-Ela

011-2247754 / 011-2228891

Kadawatha

No. 341, Kandy Road, Kadawatha

011-2922340 / 1

Kaduruwela

No. 626, Main Street, Kaduruwela

027-2223333

Kaduwela

No. 506G, Colombo Road Kaduwela

011-2548170 / 011-2538025

Kalawana

No. 70, Mathugama Road, Kalawana

045-2255411 / 2

Kaluthara

No. 282, Main Street, Kaluthara South

034-2236363

Kalmunai / saintha marthu

No. 05, Amman Kovil Road, Main Street, Kalmunai

067-2225853 / 4

Kandy

No. 05, Dewa Veediya, Kandy

081-2234411

Kandy City Centre

No. 05, L1 - K4, Kandy City Centre, Dalada Veediya, Kandy

081 222 1551 | 081 - 221552

Kahawatta

No. 166, Main Street, Kahawatta

045 - 2270222

Kattankudy

No. 104, Main Street, Kattankudy

065-2248641 / 2

Katugastota

No. 45, Kurunegala Road, Katugastota

081-2500461-2/081-2213466

Kegalle

No. 142/C, Royal Shopping Complex, Kegalle

035-2221634 / 5

Kilinochchi

No. 81,83,85 A9 Road, Kilinochchi

021-2280140 / 1

Kiribathgoda

No. 60, Kandy Road, Kiribathgoda

011-2910965

Kochchikade

No. 108, Chilaw Road, Kochchikade

031 - 2272917/031 - 2279810/031 - 2272918

Kotahena

No. 200 George R. De Silva Mawatha, Colombo 13

011-2337601 / 2

Kottawa

No. 29, High Level Road, Kottawa

011-2783886 / 7

Kuliyapitiya

No. 139, Madampe Road, Kuliyapitiya

037-2284564 / 5

Kurunegala

No. 25, Rajapihilla Road, Kurunegala

037-2224142/037-2224461-2

Maharagama

No. 135, High Level Road, Maharagama

011-2838668 / 9

Malabe

No.09, Athurugiriya Road, Malabe

011-2442714

Pettah Main Street

No. 143, Main Street, Colombo 11

011-2337707/011-2337708

Manipay

No. 172,172/A, Jaffna Road, Manipay

021-2256120

Matale

No. 129,Main Street, Mathale

066-2234332 / 3

Matara

No. 05, Hakmana Road, Matara

041-2225500-1

Matara city

Matara 2nd Branch, New Tangalle Road, Kotuwegoda, Matara

041-3406124 / 041-2228671

Mathugama

No. 116/1, Agalawatte Road, Mathugama

034-2247606,034-2249394

Medirigiriya

No. 308, School Junction, Medirigiriya

027-2248797 / 027-2248870

Monaragala

No. 45, Wellawaya Road, Monaragala

0552277429

Moratuwa

No. 129 A, Galle Road, Moratuwa

011-2642336

Morawaka

Isuru Tower, Deniyaya Road ,Morawaka

041-2282020 / 041-2282460

Mt . Lavinia

No. 295 Galle Road, Mount Lavinia

011-2717547 / 8

Narahenpita

No. T 29 & 30 Dedicated Economic Center Narahenpita

011-2369651 / 3

Nawala

No. 540, Nawala Road, Rajagiriya

011-2880880

Nawalapitiya

No.13B, Urban Council Road, Nawalapitiya

054-2222850 / 0542223508

Narammala

No. 10, Kurunegala Road, Narammala

037-2249155, 037-2249004

Negombo *

No. 454, Main Street, Negombo

031-2227555 / 6

Nelliady

No. 30, Thangasthan , Point Pedro Road, Nelliady

021-2264706

Nikaweratiya

No.78, Puttlam Road, Nikaweratiya

037-2260593 / 0372260594

Nivitigala

Rathnapura Road, Nivithigala

0452279292 / 0452278610

Nugegoda

No.24, Nawala Road, Nugegoda

011-2814038 / 9

Nuwara Eliya

No. 58A / 60, Park Road, Nuwara-Eliya

052-2223568 / 9

Oddamavadi

No. 600, Main Street, Oddamavadi

065-2258342

Panadura

No.389 Galle Road, Panadura

038-2241630 / 1

Peradeniya

No. 901 A, Peradeniya Road, Kandy

081-2387673 / 4

Pettah

Unit 8,9,10, Peoples Park Complex, Colombo 11

011-2335456 / 7

Piliyandala

No. 01, Old Road, Piliyandala

011-2609700 / 1

Premier Centre

6B Albert Crescent, Colombo 07

011-2680000-3

RATNAPURA

No. 46, Bandaranayake Mawatha, Rathnapura

045-2223667 / 9

Tangalle

No. 33, Beliatta Road, Tangalle

047-2241296 / 97

Thambuththegama

Anuradhapura Road, Thambuththegama

025-2275505 / 025-2275544

Tissamaharama

No. 46, Hambanthota Road, Kachcheriyagama, Tissamaharama

047-2239343 / 047-2239381

Trincomalee

246, Ehamparam Road, Trincomalee

026-2225555

VAVUNIYA

No. 7B, Horowpathana Road, Vavuniya

024-2226622/024-2226600

Wattala

No. 424, Negombo Road, Wattala

011-2949148 / 9

Wattegama

No.136, Kandy Road, Wattegama

081-2470933

Weligama

No. 354/45 Samaraweera Place, Weligama

041-2254600

Welimada

No.15, Nuwara Eliya Road, Welimada

057-2244912

Wellawatte

No. 02, 33rd Lane, Wellawatte

011-2362741

Wennappuwa

No. 194, Colombo Road, Wennappuwa

031-2253653/0312251994

Focus on Micro, Small and Medium Enterprises (MSME)

Established in 2016, the MSME unit addresses the financial needs of Small Business Enterprises (SBE) and has increased the Bank’s penetration of the Small and Medium Enterprises (SME) sector. SBEs are enterprises positioned between SMEs and informal micro-enterprises. The Association of Development Financing Institutions in Asia and the Pacific (ADFIP) awarded DFCC Bank in May 2017 in the “SME Development” category for forming a specialised unit for the development of MSMEs.

The MSME unit offers “Vardhana Sahaya”, a financial solution that provides loans, leases, bank guarantees, and other commercial facilities below LKR 3 million to SBEs involved in key sectors of the economy, including Agriculture, Livestock, Manufacturing, Services, and Trading. The Bank granted credit facilities to approximately 1,000 MSME customers in 2017 through Vardhana Sahaya and the Swashakthi Government funded credit scheme.

With the participation of key personnel from the Central Bank of Sri Lanka, the Bank commenced “Sahaya Hamuwa” in conjunction with the new product, a customer skill-enhancing programme series. Eight “Sahaya Hamuwa” programmes were conducted across many parts of the country, focusing on ‘Entrepreneurship and Financial Literacy’. Aimed at entrepreneurs of SBEs, the programme provided an insight to entrepreneurship development, marketing, accounting, and record keeping.

New Product and Service Innovations

DFCC Virtual Wallet

The first of its kind in Sri Lanka’s banking industry, the DFCC Virtual Wallet is an innovative mobile payment solution used by over 12,000 customers and over 1,100 merchants, a significant milestone.

The product has rapidly captivated both merchants and individuals, with increasing usage reported at both ends. The merchant base expanded into the E-commerce sector, and the Bank partnered with WebXpay to further strengthen its entry into the segment. The Bank also partnered with Aequm Lanka (Private) Limited to strengthen face-to-face transaction acceptance at small merchant locations.

Boosting the product’s inherent convenience to customers, DFCC Chatz, an online chatbot, can be accessed via Facebook. The chatbot provides instant feedback on information relevant to the DFCC Virtual Wallet for both customers and merchants.

Customers were treated to exciting seasonal offers, with steep discounts at popular merchants, including online stores, clothing stores, restaurants, supermarkets, taxi services, and fresh seafood stores. Participating retailers were Tash, Laugfs supermarkets, Cotton Collection, Max Mara, Divine, Sandwich Factory, Kangaroo Cabs, Takas.lk, MyDeal.lk, OceansBestlk.com, and Direct2Door.lk. DFCC Virtual Wallet customers were afforded the opportunity to make use of this season’s most generous discount offers.

The promotions conducted at business locations and other prominent marketing campaigns helped to successfully raise awareness of the product in the market and increase transactions routed through the application by new and existing users. The Bank is proud to spearhead this unique digital innovation that has helped to revolutionise payments and convenience to its customers, and will continue to encourage individual users and merchants to move away from the traditional use of physical cash.

Adding further value to the product in 2018 through promotions, campaigns and effective cross-selling, the Bank will continue to refine the product through new developments aimed at offering Sri Lankans liberal access to transacting via their mobile phones.

Lanka Money Transfer (LMT)

Lanka Money Transfer (LMT) is a state-of-the-art remittance system which enables instant remittances to accounts maintained at DFCC Bank PLC and any LMT Partner Bank/Financial Institution via a secure network. Migrant workers are able to quickly and securely remit their earnings through this service to their loved ones back home. Funds are credited to the beneficiary’s account held at DFCC Bank or any other account held with LMT Partner Banks/Financial Institutions with minimal hassle. Adding to the convenience for customers, the Bank has ensured that it houses the best exchange companies under one roof.

Premier Go

DFCC Bank launched “Premier Go”, the first premier banking app in the industry, exclusively for the Bank’s premier customers in November 2017.

In addition to providing secure access to account and transaction information, the app empowers premier customers with direct access to their dedicated Relationship Manager via video conferencing.

Further details can be found on Industry Initiatives.

Product Responsibility

Transparency and clarity in product labelling is not only a responsibility of the Bank, but can also drive product sales. Consumers are increasingly tech-savvy and expect to be well-informed before committing to purchases and services. Social media and other online sources provide consumers with the means to broadcast their dissatisfaction to broad audiences, which can have negative impacts on the Bank’s business and reputation.

DFCC Bank takes every effort to provide transparent and relevant information to its customers. Information about products and services are made available in all three languages, and employees are available to provide further information where necessary. The Bank also conducts events island-wide aimed at educating current and potential customers about products and services.

Focus on Social Responsibility

DFCC Bank offered “Vardhana Sahanaya”, a DFCC Bank-funded concessionary loan scheme, to rebuild the lives of the public affected by the floods and landslides that took place in 2017. The scheme was offered to both customers and non-customers of the Bank, and was used to rebuild business and personal assets. Facilities under the “Athwela” concessionary loan scheme funded by the Government were also offered by the Bank to the business community affected by these natural disasters.

Customer Privacy

DFCC Bank recognises the importance of protecting its customers’ privacy as a key component of building trust and developing the relationship between the Bank and its customers. To this extent, the Bank utilises secure systems and procedures throughout banking transactions, and continuously works to develop and upgrade these systems. Moreover, “customer privacy” is an integral part of the employee Code of Conduct, aimed at ensuring that employees recognise the importance of protecting their customers’ privacy and continue to uphold the Bank’s secure systems and procedures.

Customer Satisfaction and Complaint Handling

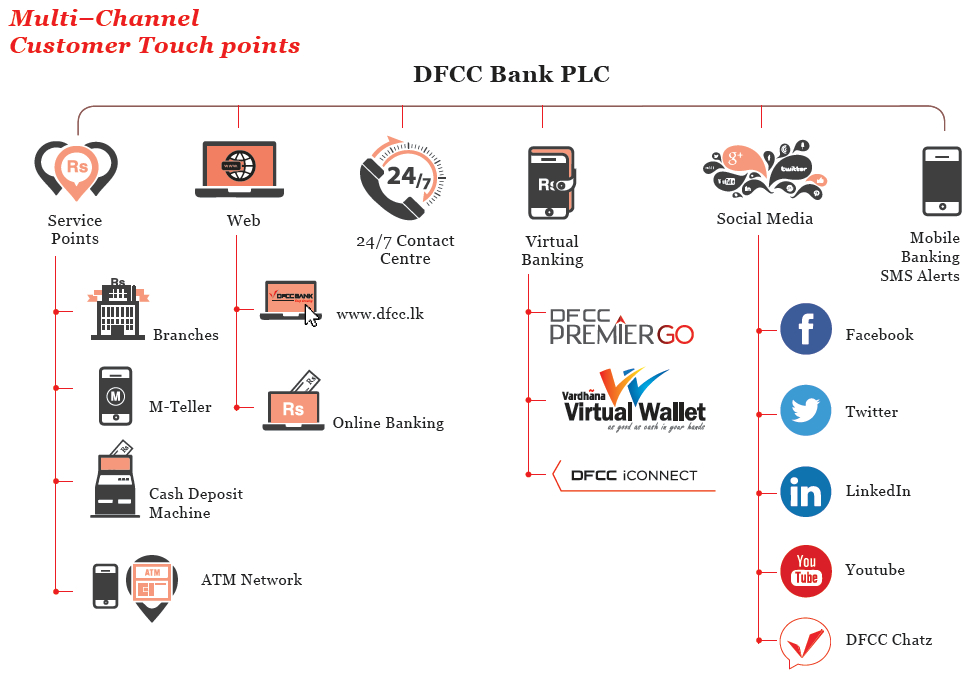

The Bank has a wide network of customer touch points ranging from the conventional brick and mortar to Internet and mobile centric digital banking solutions such as "Virtual Wallet" and "Premier Go". Given the fast changing customer aspirations and preferences, it is imperative that the Bank uses banking technology to reach the customer. While some of the customers prefer to continue to bank the conventional way with a human touch, there is a new generation of customers who demand a contextual banking experience. The Bank will continue to innovate ways and means of increasing its reach further.

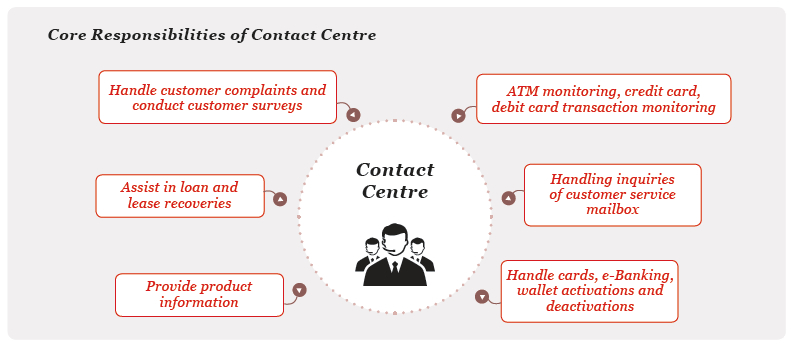

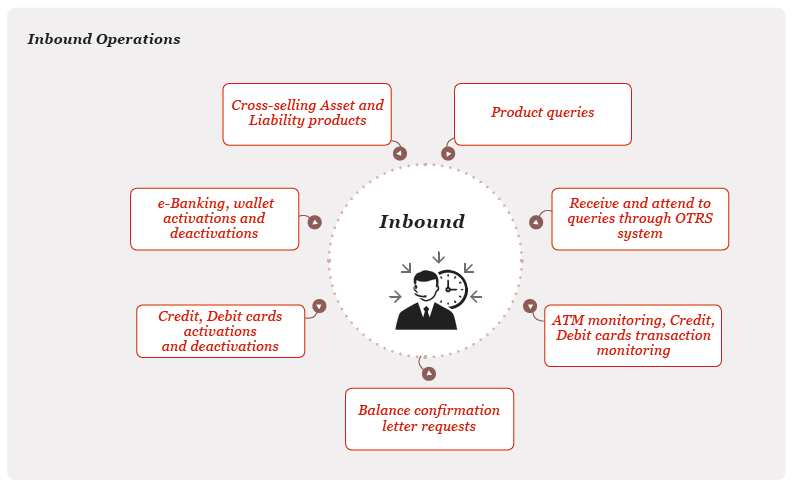

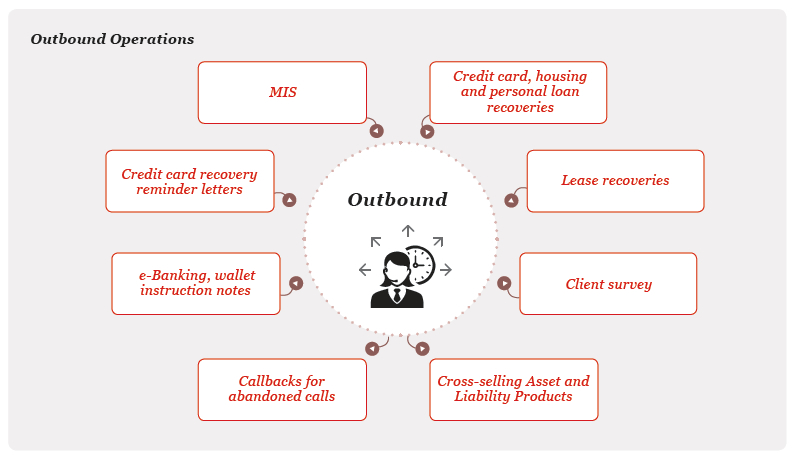

Contact Centre

Operating under the Alternate Channels Department, the Contact Centre is an important service provider as a channel that acts as the first point of contact for customers who call the Bank. The Contact Centre conducts both inbound and outbound functions and operates 24 hours, seven days a week to ensure the smooth functioning of the Bank’s operations.

Handling Product Queries and Activations

Contact Centre staff members are trained and coached on the Bank’s products, and receive briefings whenever a new product or system is launched. A comprehensive customer validation methodology has been adopted and is conducted prior to providing any information to customers.

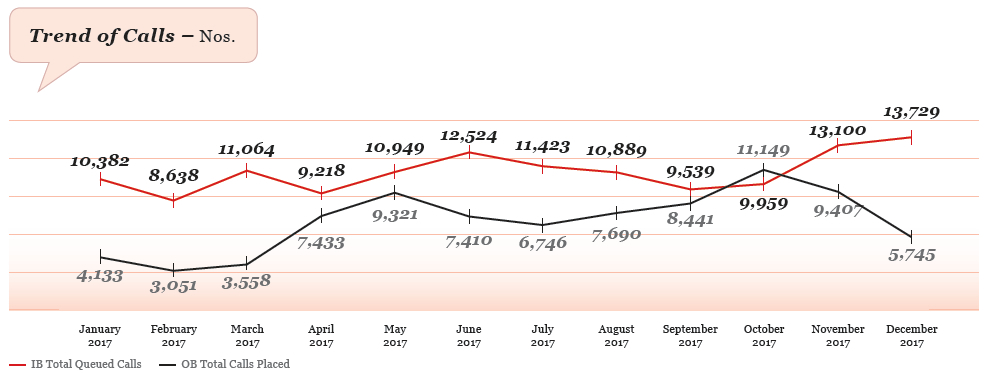

Summary of Inbound and Outbound calls

| Inbound 2017 | Duo system | Facetone system | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||

| Total queued calls | 10,382 | 8,638 | 11,064 | 9,218 | 10,949 | 12,524 | 11,423 | 10,889 | 9,539 | 9,959 | 13,100 | 13,729 | ||

| Total answered calls | 9,427 | 7,762 | 9,848 | 8,227 | 10,237 | 11,379 | 9,958 | 9,288 | 8,194 | 9,317 | 11,922 | 12,872 | ||

| Average answered calls per day | 304 | 277 | 318 | 274 | 330 | 379 | 321 | 300 | 273 | 301 | 397 | 415 | ||

| Average talk time (Sec.) | 148 | 142 | 148 | 163 | 172 | 128 | 108 | 119 | 116 | 199 | 129 | 124 | ||

| Average ACW time (Sec.) | 7 | 7 | 5 | 22 | 19 | 17 | 14 | 13 | 0 | 16 | 11 | 10 | ||

| Average answer time (Sec.) | – | – | – | 10 | 9 | 8 | 9 | 9 | 2 | 10 | 7 | 7 | ||

| Outbound 2017 | Duo system | Facetone system | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||

| Total calls placed | 4,133 | 3,051 | 3,558 | 7,433 | 9,321 | 7,410 | 6,746 | 7,690 | 8,441 | 11,149 | 9,407 | 5,745 | ||

| Average calls placed per day (Week days) | 197 | 170 | 155 | 437 | 466 | 371 | 321 | 350 | 444 | 557 | 448 | 302 | ||

| Average talk time (Sec.) | – | – | – | – | – | 53 | 47 | 54 | 54 | 60 | 63 | 72 | ||

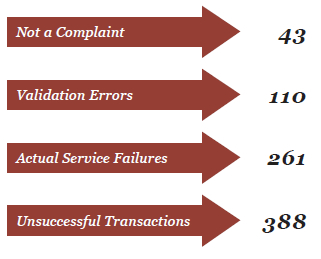

Complaint Management through OTRS

The Call Centre monitors complaints received through the hotline, complaints line, and customer service mailbox. If a resolution cannot be provided by the Call Centre on the first attempt to address a complaint, it is escalated to the relevant department, branch, or the Management, and at the end of each month, a report consisting of the total complaints received (IRM Report) is sent to the Operational Risk Manager of the Integrated Risk Management Department.

Causes of complaints are identified under three categories, and the number of complaints received under each category are depicted in the following table:

Complaints Summary

| 15 One new branch and 14 extension offices converted to fully-fledged branches |

||

| 13% growth in personal loans |

||

| 44% year-on-year growth in institutional deposits |

||

| 13.1% year-on-year growth in import/export volumes |

Summary of Complaints Received During the Year

- Two complaints were received on loans disbursement. These indirectly affected the Bank’s reputation as customers were disappointed that their loan applications were not successful within the expected time period. Irregularities in loan disbursements and miscommunication with potential loan clients led to these complaints.

- Eight complaints were received due to a lack of knowledge in banking operations and non-adherence to the standard operational procedures laid down by the Bank. Some of these complaints were mainly due to lapses in the service offered to customers and the lack of professionalism with which situations had been handled.

- Six complaints were received due to technological issues. These can normally occur in banking operations, but are not considered acceptable by customers. Examples of such issues included receiving several emails after online banking transactions, delays in updating credit card payments, deduction of extra charges for accounts (WHT), and delays in renewal notices of fixed deposits.

- One complaint was received as a result of the disclosure of a customer’s facility details to a third party.

- Two complaints were received due to the return of cheques without the customer receiving prior notification.

Additionally, issues that did not fall into the aforementioned categories are listed below:

- Not a complaint: complaints received from an unsatisfied customer despite the Bank having performed its services successfully. (e.g. Debit card PIN has not been received, but was duly dispatched by the Bank to the correct mailing address) 43 complaints were received.

- Validation errors: Incorrect information that has been input into the co-banking system. (e.g. Incorrect NIC number, incorrect residence address and incorrect name in the EOC system). 131 complaints were received.

- Actual service: Service lapses and violation of service level standards are considered as actual service failures. 275 service failures were reported.

- Unsuccessful transactions: Complaints received about ATM withdrawals that were debited from the customer’s account but not received by the customer are considered as unsuccessful transactions. Out of 388 complaints, six transactions are still under pending status as at 31 December 2017. 70 complaints related to DFCC Virtual Wallet promotions were received. These complaints were due to merchant service level agreement failures, merchant system issues and DFCC Virtual Wallet system failures. Refunds have been given to all these customers who encountered issues and needed settlement.

Marketing Communications

The Bank undertook several brand-building initiatives during the course of the year, including marketing and seasonal campaigns, event sponsorships, and customer engagement activities.

Through a Board approved Corporate Communications Policy and Social Media Policy, the Bank engages with customers and potential customers over multiple channels of communication in English, Sinhala, and Tamil. The Bank takes every effort to ensure the accuracy of information and compliance with the CBSL and the Bank’s Customer Charter.