- Messages

- Profiles

- Business

Model - Management Discussion

and Analysis - Stewardship

- Integrated Risk Management

- Corporate Governance

- Annual Report of the Board of Directors on the Affairs of the Bank

- Report of the Audit Committee

- Report of the Human Resources and Remuneration Committee

- Report of the Nomination and Governance Committee

- Report of the Board Integrated Risk Management Committee

- Report of the Credit Approval Committee

- Report of the Related Party Transactions Review Committee

- Directors’ Statement on Internal Control

- Independent Assurance Report

- Investor

Relations - Financial

Reports- Financial Calendar

- Statement of Directors’ Responsibilities in Relation to Financial Statements

- Chief Executive’s and Chief Financial Officer’s Statement of Responsibility

- Independent Auditors’ Report

- Income Statement

- Statement of Profit or Loss and other Comprehensive Income

- Statement of Financial Position

- Statement of Changes in Equity

- Statement of Cash Flows

- Notes to the Financial Statements

- Other Disclosures

- Supplementary

Information

Business Model

Strategic Direction and Outlook

Short, Medium and Long-term Goals of the Bank

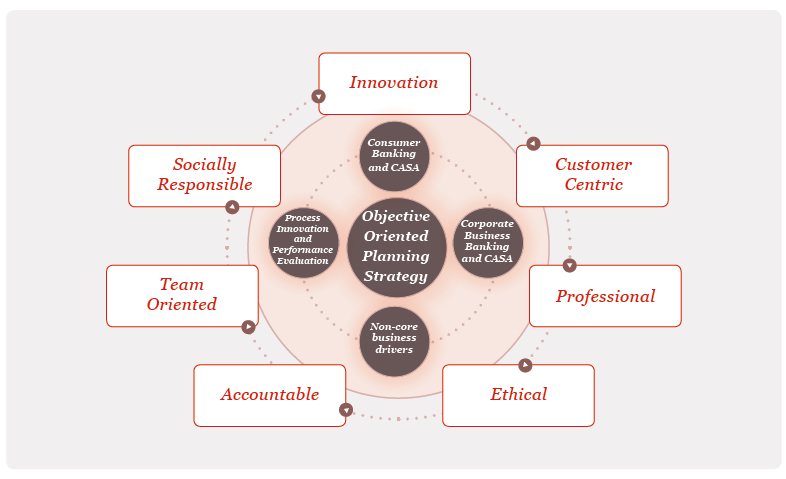

In keeping with the vision to be the leading financial solutions provider, the Bank set about formulating short, medium and long-term goals spanning from 2018 to 2020 and beyond. The Bank looked at its long-standing heritage of national development, the promotion of entrepreneurship and SME, and the recent move into the fully-fledged commercial banking space. The goals were formulated around the seven core values of the Bank and corporate planning sessions were arranged built on the pillars of Objective Oriented Planning Strategy (OOPS).

During the period 2018-2020, the Bank will focus on four main areas:

- Consumer banking and Current Accounts and Savings Accounts share of wallet

- Business banking and corporate banking share of wallet

- Non-core business drivers to increase other income

- Process innovation and performance evaluation

The Bank intends to maximise resource utilisation towards improving the customer experience and offering better customer convenience, including improving the digital customer experience in order to achieve customer satisfaction, retention, loyalty and engagement.

In an effort to broaden the customer base of the Bank, a number of strategic initiatives derived through OOPS have been established in different customer segments. Some of these initiatives include user-friendly online banking solutions and actively engaging customers through more loyalty building activities across customer touchpoints. As part of the OOPS initiative, a re-evaluation of the current business model of the Bank was undertaken, based on a nine building block analysis technique. This includes analysis of customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partners, and cost structures in order to shift the Bank’s perspective from organisation-centric to customer-centric.

In general, the Bank focuses on enhancing productivity at branch level while reducing the paperwork of day-to-day operations in an effort to move towards a modern paperless work environment and establish a sustainable green banking solution. As measures of improved business processes, the Bank intends to implement the principles of lean management, truly paperless processes, improved workflow tools and automated task management.

Additionally, the Bank intends to improve MIS and innovation while focusing on customer profitability, employee motivation and engagement. The Bank plans to carry out marketing and promotional activities in the city and rural areas with the objective of raising brand awareness and creating a strong position in the minds of consumer banking customers.

SWOT Analysis

| Strengths | Weaknesses | |

|

|

| Opportunities | Threats | |

|

|